Month: May 2022

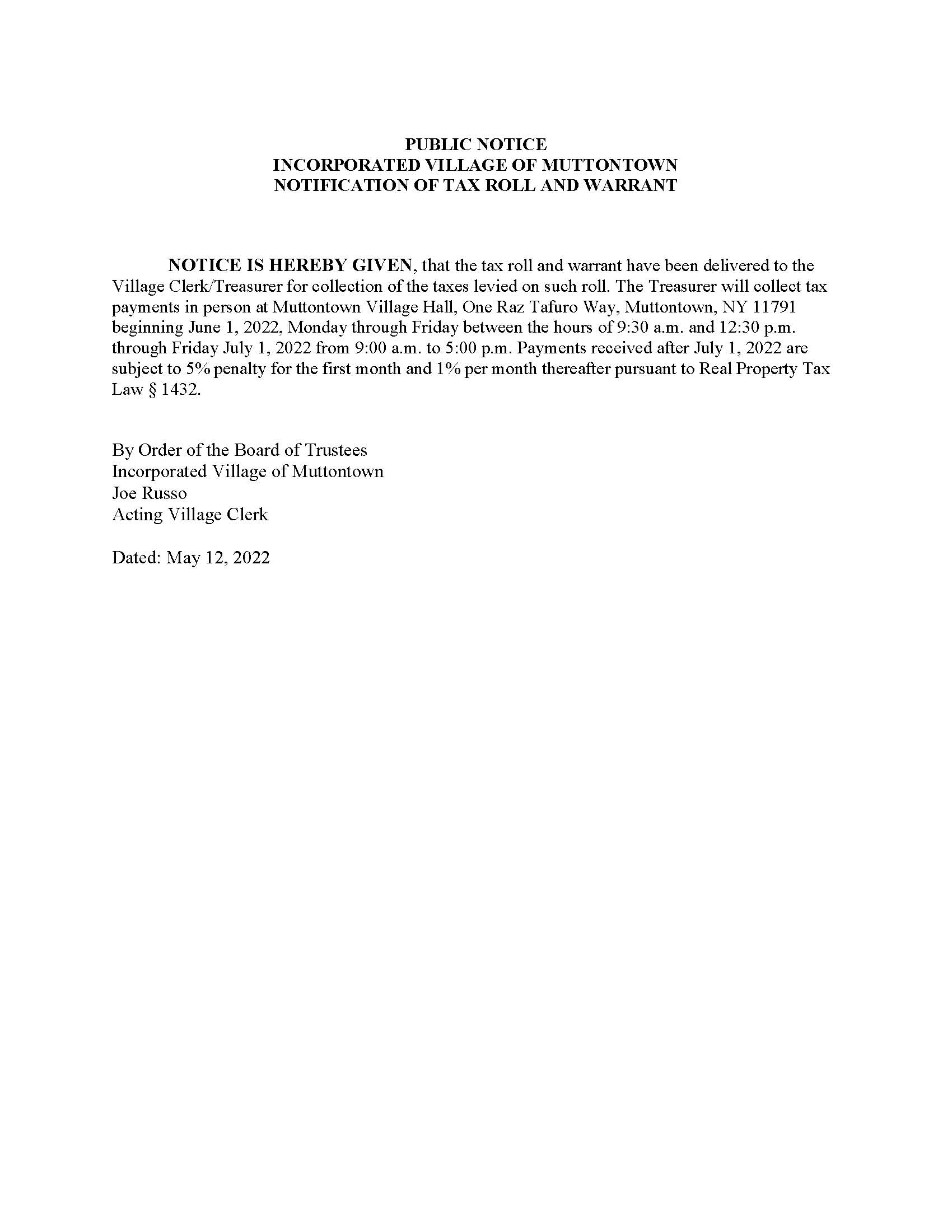

Public Notice Notification of Tax Roll and Warrant

NOTICE IS HEREBY GIVEN, that the tax roll and warrant have been delivered to the

Village Clerk/Treasurer for collection of the taxes levied on such roll. The Treasurer will collect tax payments in person at Muttontown Village Hall, One Raz Tafuro Way, Muttontown, NY 11791 beginning June 1, 2022, Monday through Friday between the hours of 9:30 a.m. and 12:30 p.m. through Friday July 1, 2022 from 9:00 a.m. to 5:00 p.m. Payments received after July 1, 2022 are subject to 5% penalty for the first month and 1% per month thereafter pursuant to Real Property Tax Law § 1432.

By Order of the Board of Trustees

Incorporated Village of Muttontown

Joe Russo

Acting Village Clerk

Dated: May 12, 2022